|

|

|

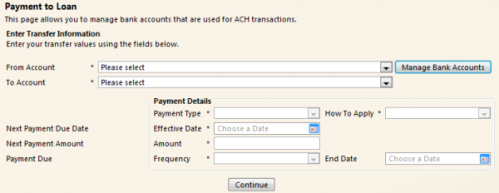

Transactions > Payment to Loan

|

|

|

The Payment to Loan page enables you to easily transfer funds from an external checking

or savings account to your Farm Credit Services of America loans. The funds are

transferred via an ACH transaction. The transfer can be initiated one-time or on

a recurring basis.

To transfer funds from your external checking or savings account, follow these steps:

- Choose the external account that the funds will be withdrawn from.

- Choose the online account that the funds will be transferred to.

- Choose the Payment Type:

- Exact Billed Amount – Indicates that you wish to make your billed installment.

- Other Amount – Indicates that you wish to make a non-regular payment or pre-pay your next

billed installment.

- Choose How to Apply. If you chose the Other Amount Payment Type option, you must indicate

how you want the payment applied to your loan:

- Special Interest Payment – Indicates that you wish to make an interest payment.

- Next Due Interest Payment – Indicates that you wish to pre-pay all or a portion of your

interest for your next billed installment (limitations exist on the amount of prepayments

that are allowed on your account).

- Special Principal Payment – Indicates that you wish to make a special principal payment.

Choosing this option does not affect your subsequent billed installments.

- Next Due Principal Payment – Indicates that you wish to pre-pay all or a portion of your

principal for your next billed installment (limitations exist on the amount of prepayments

that are allowed on your account).

- Choose the appropriate Effective Date.

- Choose the appropriate Amount. Note: If the Exact Billed Amount Payment Type is chosen,

then the amount automatically populates with the appropriate billed amount.

- Choose the appropriate Frequency.

- Choose an End Date (optional).

- Click ‘Continue’ to accept the details of the Internal Transfer. Choose ‘OK’ or

‘Cancel’ to continue with the transaction.

-

- Saved transactions will display in a grid at the bottom of the screen.

- Transactions can be deleted prior to the processing date.

- Changes to a transaction must be made by deleting the original transaction and creating

a new transaction.

Q: When will my account be credited?

A: Your account will be credited on the scheduled effective date. ACH receipts are

1-day effective, which means that they are processed 1 day prior to the scheduled

effective date.

Q: What if I pick a payment date that is a processing holiday?

A: Our system will not let you create a receipt that is scheduled to process on

a holiday. You will receive an error message and be instructed to enter a new effective

date for the transaction.

Q: If I create a recurring transaction and one or more of the recurring payments

are on a processing holiday, what happens?

A: As explained above, you will not be able to schedule the initial instance of

a recurring transaction on a processing holiday. However, if the recurring instances

of the transaction happen to fall on a processing holiday, the system will move

that instance of the payment forward one day to a non-processing holiday. This will

occur when the previous instance of the transaction has been processed and the upcoming

instance is scheduled.

Q: What if I don’t like the day to which the recurring transaction was moved?

A: You can delete the rescheduled instance of the transaction via the Payment to

Loan page (located at the bottom of the screen) and create a new transaction to

replace that particular instance of the recurring transaction. All future instances

of the recurring transaction will remain scheduled based on the initial transaction

schedule.

Q: How do I pay off my loan?

A: Please contact your local retail office if you would like to pay off your loan.

|